![]()

Elliot Wave discussion by brach

given on 1/19/02 in the PalTalk voice chatroom "E-Mini Traders Anonymous,"

and transcribed by buffy_04364

(03:04 PM) brach: hi

(03:04 PM) hanksterr: is class starting nowfor Elliot Waves

(03:04 PM) brach: ask away

(03:05 PM) hanksterr: okay teach me using EW how to make a fortune lol

(03:06 PM) brach: EW isn't a trading system. it's just a tool

(03:07 PM) google_2: how do you use EW?

(03:07 PM) TurnSig: How do you deal with the Irregular B waves.

(03:07 PM) Brach: use them carefully

(03:07 PM) hanksterr: start with knowing where wave 1 starts

(03:08 PM) google_2: are there any special fib levels or signs that show termination of a certain wave?

(03:08 PM) Brach: what do you do when expecting 5 and you get 6th and 7th

(03:08 PM) Brach: depends on the context in which wave patterns appear

(03:08 PM) Brach: first thing look at is support and resistance

(03:09 PM) Brach: I look at stoch for divergence

(03:09 PM) Brach: length of waves and use candles and fibs to answer questions.

(03:09 PM) laniermasters: How do you use other indicators in conjuction with the fib numbers?

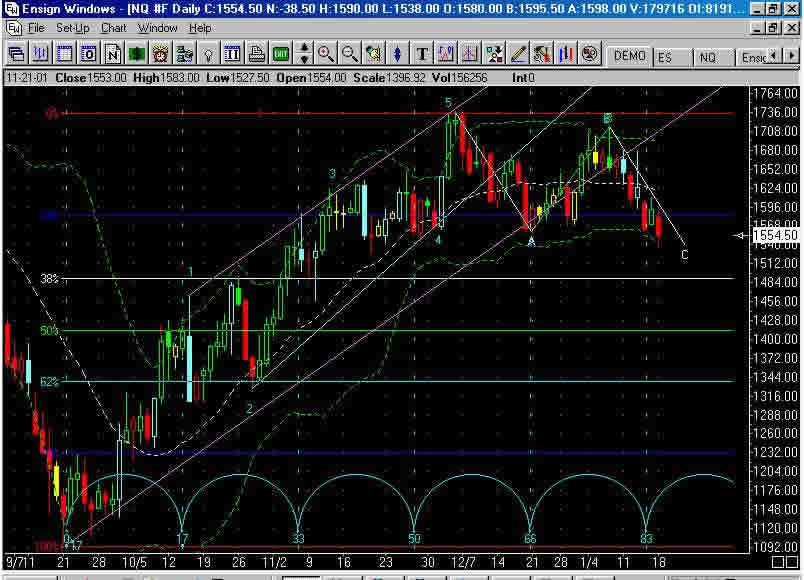

(03:09 PM) google_2: you have a chart to walk us through some examples?

(03:09 PM) Brach: like has wave one started is wave 5 over

(03:10 PM) Brach: I have some charts but if you look at charts posted last week mon - weds you will find examples of wave counts

(03:10 PM) Brach: one I am looking for is good at projecting this five wave downturn

(03:11 PM) Brach: this is the link to the chart

(03:12 PM) google_2: ok what timeframe do you use for counting?

(03:13 PM) Brach: I start with the larger tf like daily and count lower tf in such a way of what I expect in larger tf

(03:13 PM) Brach: if scalping am more interested in where going in next 5M

(03:13 PM) hanksterr: so was that wave 1 because it is the first swing down on the chart

(03:13 PM) Brach: the larger wave counts are useful for trying to figure out objectives

(03:14 PM) Brach: let me find chart I put up a couple of weeks ago

(03:15 PM) Brach: is another chart

(03:15 PM) Brach: showing parallel Channel

(03:16 PM) Brach: Shows a triangle

(03:16 PM) Brach: Big Picture wave count on the nd#F

(03:17 PM) Brach: ES daily

(03:18 PM) hanksterr: how do you tell that is a wave 1

(03:19 PM) hanksterr: es daily

(03:19 PM) hanksterr: last posted

(03:19 PM) Brach: I counted 5 waves up and there might of been a subdivsion in there

(03:20 PM) 1goods: on the daily ..brach.. is that 5 waves up from Sept21

(03:20 PM) Brach: we had large correction I called wave 2

(03:20 PM) hanksterr: can u count backwards

(03:20 PM) google_2: is there a certain percentage/fib/level whatever you use to determine invalidation of a wave or change in count?

(03:20 PM) hanksterr: from wave 5 top

(03:20 PM) Brach: the first thing I look for if I think I have wave one wave 2 retraces 68 - 79% of wave one

(03:21 PM) Brach: other wave objective is it will go down to the previous wave 4 and is usually 38%

(03:21 PM) brach: 68-79%

(03:21 PM) 1goods: on the daily ..brach.. is that 5 waves up from Sept21

(03:21 PM) brach: for wave 2 or wave B

(03:22 PM) brach: wave 4 is usually 38%

(03:22 PM) Brach: fact if you look at the 15M demo today you can see an example of these %

(03:22 PM) Brach: wave 2 turned out to be 50% wave 4 was 38%

(03:23 PM) Brach: wave 5 tends to be the same length as wave one so you can project a target for wave 5 if you think it has begun

(03:23 PM) laniermasters: How do you use other indicators in conjuction with the fib numbers and wave counts?

(03:26 PM) Brach: The indicator I like to use the most is the stoch cause it shows divergence nicely. I like to see divergences also by looking at a histogram. The histogram is the spread between %k and %d and will show divergences even when lines do not

(03:29 PM) tippet: brach maybe we can look at the last 2days on nq and u can tell us how u broke it down from a15 & say 1min chart also explain whether u see a 3wave pattern or 5?

(03:30 PM) Brach: tippet let me look at nq

(03:31 PM) Brach: this is pointing out one of the difficulties when you have protracted count it is hard to count. We have a double zigzag with second one now

(03:32 PM) Brach: other way is to say we have 5 wave count with one more leg down

(03:35 PM) Brach: I think there is going to be one more wave down

(03:35 PM) Brach: in particular I would look at the daily wave count

(03:35 PM) Brach: we might be in a C wave and almost over

(03:36 PM) Brach: Brach on demo 2 - why isn't the tag of the tl labeled 4

(03:36 PM) Brach: and then failed 5 I think you say

(03:36 PM) Brach: another chart is posted for the nq

(03:37 PM) 1goods: brach.. when it's over (wave C) will that be ...a wave 2 or B

(03:39 PM) Brach: we won't know if a b or wave 2 it could be either

(03:40 PM) Brach: I change stoch setting from time to time. Demo will be one,

NQ will be another depending on what I consider to be cycle length in the market

at the time. I want the period to be at least one half the cycle length.

(03:41 PM) Brach: What is going to decide if a Wave B or a Wave 2

(03:41 PM) Brach: If you look at those daily charts you will notice I use parallels

in such a way to forecast where the next wave would end particularly the corrections.

Parallel channeling is very useful in predicting wave endpoints and targets

(03:42 PM) amer_68: So you're not expecting much further down on the daily?

(03:42 PM) hanksterr: please explain cycle length more

(03:42 PM) amer_68: If C wave equals A

(03:43 PM) amer_68: 38% from where

(03:43 PM) Brach: I think we have just about bottomed out but have not met a 38% objective yet so may have little more downside as you can see what I have drawn wave C has not equaled wave a yet

(03:44 PM) 1goods: brach please..explain..@ what point do you know if it is wave 2 or B

(03:44 PM) brach: C has met the wave 4 objective.

(03:45 PM) brach: To know if wave 2 or B need to see the third wave.

(03:45 PM) brach: Don't know if 3 or 5 wave until move is over.

(03:45 PM) hanksterr: what is a cycle, wave 1 to wave 5? or what

(03:46 PM) brach: A cycle is merely the elapsed time of number of bars between one low and next prominent low. There's all kinds of cycles going on at same times in different time frames. So you pick 2 swing lows and assume that's a cycle length and project it forward and if you projection matches expections you've established a cycle length. It's really kind of subjective - eyeball the chart and use the ensign cylce draw tool.

(03:49 PM) Brach: I was talking about using swing lows and the ensign tool to establish the length of the cycle

(03:49 PM) hanksterr: that would be a great chart to post

(03:49 PM) brach: k

(03:53 PM) Brach: the vertical dots show the cycles

(03:53 PM) brach: http://www.elliottwave.com

(03:53 PM) Brach: is a good learning link

(03:54 PM) hanksterr: brach so would stoch length be 35 then for the 17 cycle

(03:55 PM) brach: i meant 1/2 the cylcle length, so the stock pd would be 8

(03:55 PM) hanksterr: okay

(03:56 PM) laniermasters: Do you have any quasi-specific rules for timing of entry and exit?

(03:56 PM) Brach: well, alot of my entries are made on 62-79% retracement or 38% on 4th wave

(03:57 PM) Brach: exits are made when objectives are reached

(03:57 PM) 1goods: brach.. wouldn't the larger degree wave count help us decide..what the correction is a 2 or B...I thought EW provides both a basis for disciplined thinking and a perspective on the market's general position and outlook

(03:57 PM) Brach: might have a few objectives so will use scale out approach or trailing stop

(03:57 PM) laniermasters: Use fib numbers to project different objective levels?

(03:57 PM) Brach: yes the context in which it occurs might help

(03:58 PM) 1goods: thank you

(03:58 PM) Brach: if you think previous is A wave then correction to that is B wave

(03:59 PM) Brach: yes lanier wave 2 is usually 68-79 retracement although B waves can go beyond

(03:59 PM) Brach: wave 5 = wave 1

(03:59 PM) laniermasters: great thanks

(03:59 PM) brach: wave 4 is 38%

(04:00 PM) brach: wave 3 is often 1.62 x wave 1

(04:00 PM) Brach: tks

(04:00 PM) brach: wave 2 or b is often 62-79% of wave 1. Although B wave can go beyond start of wave A

(04:00 PM) laniermasters: I know your results are great, but can you quantify them some way?

(04:01 PM) amer_68: Watch discussion over at Avid sometimes. There seems to be continuous revisions. And many different interpretations. You find the patterns regular enough to use? Your thoughts.

(04:02 PM) ddaylf_1: http://www.antaresequity.com

(04:02 PM) ddaylf_1: great explanation on waves

(04:02 PM) Brach: the purpose of wave theory is not to tell you what it is going to do next but use process of elimination

(04:02 PM) Brach: wave count is not used to trade but used as next probably direction market is going to go

(04:02 PM) Brach: if you don't use stops you will probably lose money like you would anything else

(04:03 PM) Brach: how do you determine when wave 5 ended

(04:03 PM) Brach: one thing I noticed wave 5 is wedges

(04:03 PM) Brach: that means wave 5 subdivides into 5 waves that overlap and take the shape of a wedge

(04:03 PM) Brach: sometimes you don't know and you wait until market gives you enough info to figure it out

(04:04 PM) 1goods: do you use volume to help you determine waves

(04:04 PM) laniermasters: Do you use 5 min for intraday?

(04:04 PM) Brach: in my own trading the patterns I find most useful are continuation triangles and diagonal triangles

(04:04 PM) Brach: I do not use volume because TF seem irrelevant in TF I trade

(04:05 PM) Brach: do look at size of bars - expansion bars usually are followed by a correction to indicate wave has come to an end

(04:06 PM) laniermasters: TF's for intraday trading? Look at one or several?

(04:06 PM) brach: I look at 1, 3, 5, 15 and 60 and daily

(04:06 PM) amer_68: continuation triangle a symmetrical triangle?

(04:07 PM) laniermasters: thx

(04:07 PM) amer_68: k

(04:07 PM) Brach: I believe we mean the same thing but the key thing is

(04:07 PM) brach: all EW triangles have 5 waves

(04:08 PM) brach: wave 4 is often a triangle

(04:08 PM) brach: wave b is often a triangle. wave 2 is rarely a triangle

(04:09 PM) Brach: how do I distinguish between wave 2 or B

(04:09 PM) Brach: wave 2 is almost never a triangle but wave B quite often forms a triangle

(04:09 PM) Brach: also if you have a second wave and trying to figure out a B wave or wave 2

(04:10 PM) brach: wave A can be 3 or 5 waves

(04:10 PM) Brach: if wave preceded it was 3 waves than that was an A wave and one under consideration must be a B wave

(04:10 PM) google_2: so for intraday you use 3 minute for wave counts?

(04:10 PM) brach: wave 1 is always 5 waves

(04:10 PM) google_2: or another timeframe?

(04:10 PM) brach: any timeframe

(04:11 PM) Brach: I trade off the 3M and often gives the least noisy pattern that is still tradeable and acceptable risk level but look at larger TF to see where going

(04:11 PM) Brach: 60M is often helpful

(04:12 PM) google_2: ok thanks

(04:12 PM) 1goods: 3 waves a flat 5 waves a zigzag...zigzags more common in wave 2 flats more common in wave 4

(04:12 PM) Brach: will look for fib objective on the 60M and adjust my trading based on fact market will move to certain price level

(04:12 PM) brach: in deciding price obj.

(04:13 PM) Brach: the daily chart I posted illustrates a common pattern for wave 4 which is quite often a triangle

(04:13 PM) google_2: thanks for your effort and info.

(04:14 PM) Brach: anyother questions for Brach?

(04:14 PM) 1goods: brach any good books on EW

(04:14 PM) brach: http://www.elliottwave.com

(04:15 PM) laniermasters: Do you typically trade several contracts and scale out?

(04:15 PM) brach: I trade 5-10 and scale out

(04:16 PM) laniermasters: Thx

(04:16 PM) 1goods: what is the best wave to trade

(04:16 PM) amer_68: Thanks for taking the time to give the class brach.

(04:17 PM) Brach: on 15M demo chart today you could see a wave five in progress and we expect it to be same as wave one and you can see it has been fulfilled

(04:17 PM) Ensign Software: I smile.

(04:17 PM) Ensign Software: Tried really hard to make DEMO be realistic.

(04:18 PM) laniermasters: Thanks a million, Brach!

(04:18 PM) QSuzy: thanks a bunch, brach....

(04:18 PM) dave_b_quick: thanks brach

(04:18 PM) hanksterr: thanks a lot brach learned some good tips

(04:19 PM) TALLMAN123: ty brach

(04:19 PM) tomsurf: brach- Thanks you for all the info. :-)

(04:19 PM) 1goods: thank you .... brach...EW not easy to teach

(04:19 PM) Brach: there is quite a few guidelines that help you make decision if in a or b but I recommend you go to the website I put in

(04:20 PM) Brach: they have a discussion there about the basics of elliot waves

(04:20 PM) TurnSig: May none of your waves make you seasick. Thanks.

(04:20 PM) Brach: they also offer a book that should be pretty good

(04:20 PM) 1goods: lol turnsig

(04:20 PM) brach: http://www.elliottwave.com